Structural reforms are long-term bets. At a time in which markets require fast euro action, Brussels and Berlin are forcing its peripheral counterparts to make them, however harsh the tensions already risen over austerity policies that slash public spending.

This mix, critics say, turns into poison when the seemingly only tool available to maintain developed economies breathing is state and central bank intervention. In Italy, to follow the European Commission's advice could result in a 2.4 percentage point-GDP growth, but not before 2020. Would it be too late?

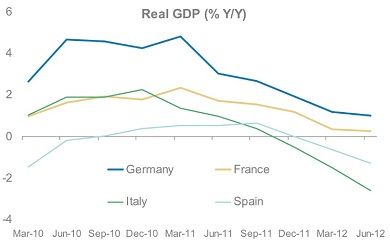

Italy has had a second quarter of the year that suggested a slightly better performance. It has finally proved to be otherwise. According to Morgan Stanley analysts, “indicators raging from hard data to business and consumer surveys, the pace of GDP contraction has accelerated lately.”

Purchasing managers' indices announce further deterioration of the manufacturing industry. In August, it dropped to 43.6 below the 50 mark that must be overpassed to enter expansion territory.

Factory new orders are now as weak as during one of the peaks of the recession, in 2009. Italian companies report vanishing demand from both the domestic and foreign sides. In fact, although the country's current account deficit should shrink below 1 percent by 2014, “this is due to the effect of recession, with domestic demand and imports falling quickly…” research from Morgan Stanley explains.

As it is the case with Spain, Italy's bond market has ended up closely tied to European developments. Tuesday's relatively small offer of sovereign debt went down without a problem and the Italian Treasury placed just about the maximum amount of paper it had planned. The main reason can be found in the European Central Bank's promise of unlimited support in the secondary market.

Yet, exports have been a skill Italy has excelled at since the inception of the euro zone, and the government needs to deal with a more manageable volume of external debt than other peripheral members.

Brussels conditions for capital aid must meet markets' requirements strengthening the economic abilities of its troubled partners, not pushing them into a desperate spot. Reforms will only work in a healing economy, and it is time to admit that not all budget cuts are equal, nor inherently bring positive outcomes.