Japan will grow more than most of the advanced economies in 2012, by close to 2.3%. But this is far from being a reliable description of Japan's current economic situation.

Activity is slowing up more sharply than expected and the Bank of Japan has been forced to act. After the downward revision of accounts for the second quarter, GDP growth went from 1.3% quarter-on-quarter in the first quarter to 0.2% in the second. Private consumption, which was exceptionally strong at the beginning of year, largely thanks to public incentives, lost steam in the second quarter and, given the latest activity indicators such as car sales in August and retail sales in July, growth will be minimal in the second half of year.

This weakness in domestic demand is also reflected in the persistence of a deflationary scenario. June's CPI fell by 0.4% year-on-year and core inflation, the general rate without foods or energy, dropped by 0.6%.

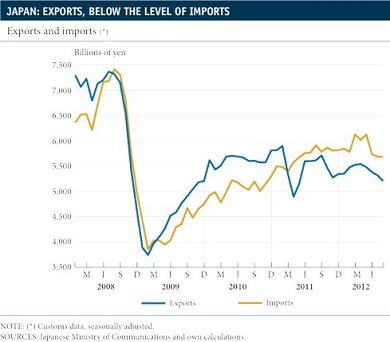

But it is in the foreign sector, the motor behind the growth of the last few years, where the greatest decline can be seen. On average, the foreign sector has deducted 0.6% from year-on-year growth in the economy as a whole after the tragedy of March 2011, when it previously contributed close to 0.8%.

One cause of this deterioration is the nuclear switch-off. Nuclear energy will disappear from Japan by 2040, the date its most modern power stations come to the end of their useful life. The decision on 14 September to eliminate nuclear energy, which before the Fukushima tragedy had met close to 30% of the country's energy requirements, introduces a change of scenario. Firstly, the bill for energy imports will increase. One sign of this are the imports of liquid gas, which went from 70 to 77 million metric tonnes in 2011 and could reach 83 million in 2012. On the other hand, energy shortages are introducing costs and bottlenecks that damage companies' competitiveness.

This larger bill for energy imports coincides with the appreciation of the yen, brought about by less attractive yields for Japan's debt than other economies in the zone and, recently, by the Fed's quantitative easing. A strong yen makes exporters less competitive at a time of weak global demand. In August, Japan had accumulated a record trade deficit of 5.2 trillion yen over the last 12 months. While exports for the period in question lost 2.1% year-on-year, imports rose by 23.6%.

This new scenario of trade deficits increasingly reduces the current surplus, which might compromise the financing of Japan's public debt, currently at 230% of GDP.

Given this situation, the Bank of Japan, whose monetary policy had been among the most restrictive in the advanced economies to date, agreed to extend its quantitative easing with the aim of calming the upward pressure on the yen. The debt purchase programme will run until December 2013 and its total will go from 70 to 80 trillion yen (from 14.7% to 16.9% of GDP).