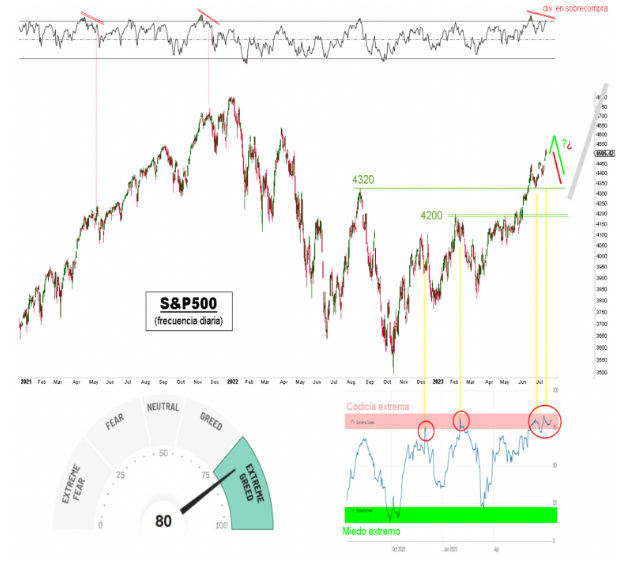

Renta 4| The rise of the S&P 500 is starting to show signs of excesses in the short term, such as the appearance of bearish divergences at high overbought levels or the excessive complacency readings in sentiment indicators. The proximity of a corrective leg in the coming weeks would not be surprising nor would it undermine the good momentum as long as the American benchmark remains above its main short-term supports, the first at 4320 points and the second at 4200 points:

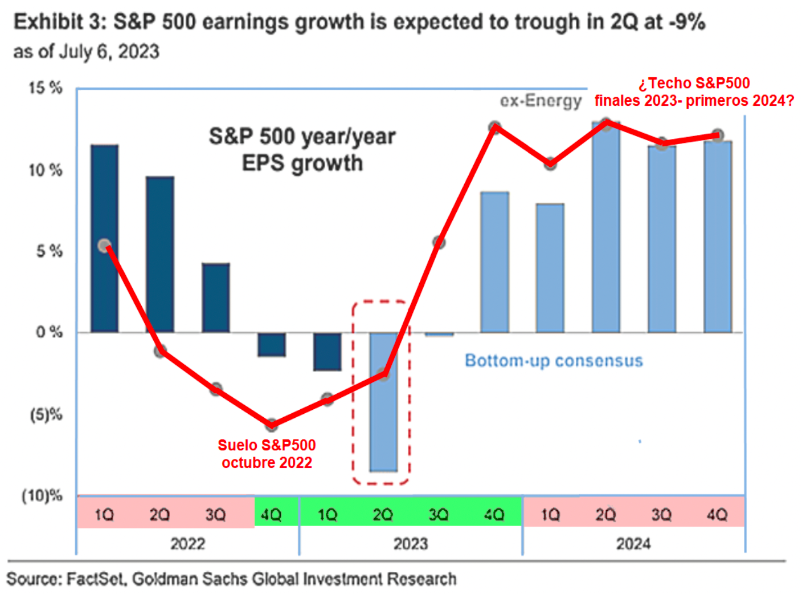

S&P500 earnings growth, a map for the stock markets?

The chart below shows Goldman Sachs’ estimates for S&P 500 companies’ earnings growth over the coming quarters, with energy companies (blue bars) and without them (red line). The correlation that the red line has been showing with the evolution of the S&P500 is striking. If the estimates are correct and the correlation continues, earnings growth would be maintained until the fourth quarter.