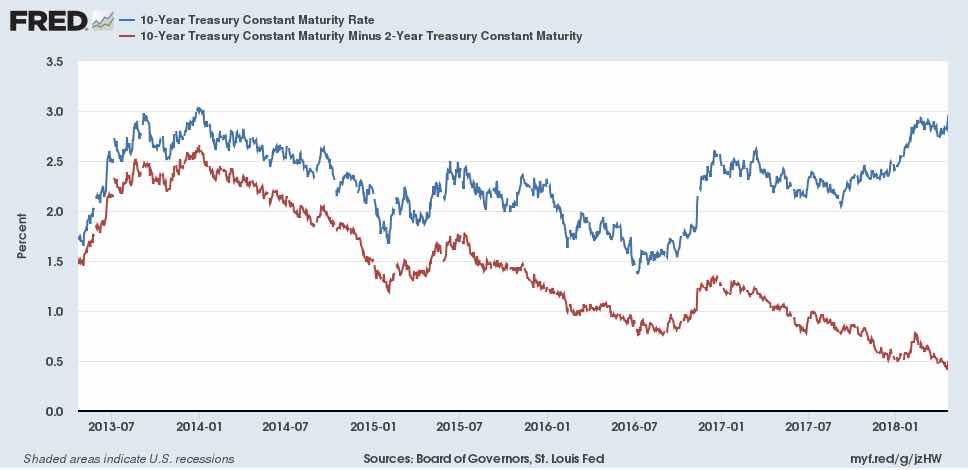

What is intriguing is that, on the other hand, the spread of the 10-year bond minus 2 years, which reflects the expectations for economic activity, including inflation, is increasingly lower. This is because the interest on the 2-year bond increases faster than that on the 10-year bond. In any event, increasingly more subdued expectations for an economic recovery.

In reality, as John Authers highlights, the yield on the 2-year bond has indeed gone up, proportionally, more than that on the 10-year bond, from 1.6% mid-2016 to 2.44%.

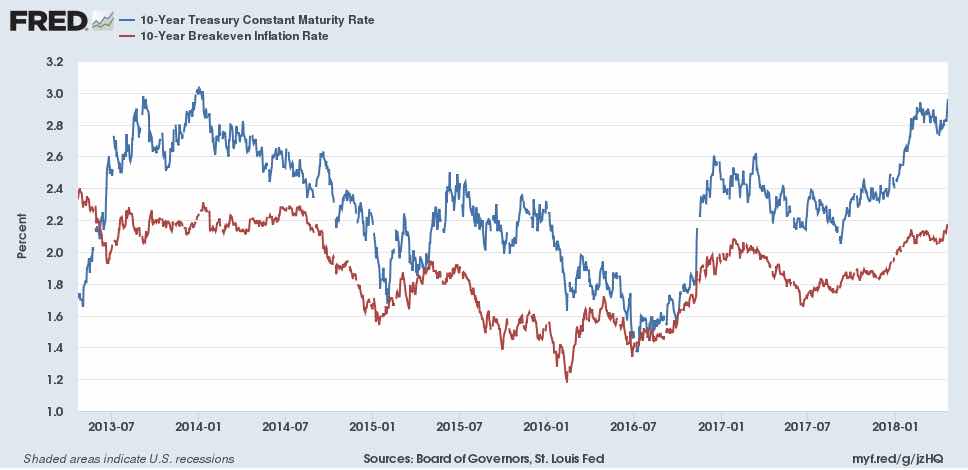

In summary, we are faced with an intriguing situation, where a slowdown in GDP is expected, at the same time as an acceleration in inflation – fuelled by the prior rise in oil prices. Meanwhile, the 10-year bond, the most important one, is at worrying levels. Authers says:

The markets would indicate that investors are protecting themselves against future interest rate moves. But that the Fed will hold back on any rise in rates next year and then will reduce them in three years.

I have had to read these sentences three times to understand anything. But I believe the main contradiction is an expected rise in inflation with a expected moderation in economic activity. Not because inflation grows of its own accord, but because they usually advance hand in hand at moderate levels. But if what is expected is that the increase in the cost of energy is more of a brake than a stimulus on consumption and investment activity? Now that is understandable.