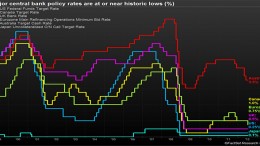

“Deflation Remains More of a Threat to Growth Than Low Interest Rates”

Are we putting the responsilibity of exiting the crisis on central banks’ shoulders? Is ECB’s president Mario Draghi doing traders a favour by playing down the ECB’s responsibility for contributing to volatility? Professor of Financial Mathematics at Bocconi’s University Marcello Minenna answers to these questions from Milan and argues that a low interest rate environment is here to stay.