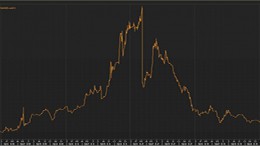

DAX rocketing, Spanish risk premium at 120bp (and financing costs match US)

MADRID | The Corner | Despite the good performance of Western equities, many values are beginning to show signs of vertigo that could lead them to correct some of the gains of the past weeks in the coming days. In addition, the fact that trading volumes are shrinking as indexes advance is a clear sign that there are investors who feel dizzy levels. Therefore, Link experts point out, we shouldn’t rule out some small reductions in the short term even if it’s in an upward trend context.