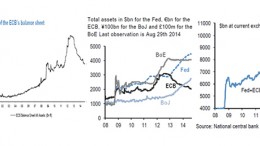

Central Banks that make the same mistake are ‘rewarded’ with similar outcomes

SAO PAULO | By Marcus Nunes via Historinhas | While the Riksbank can focus exclusively on Sweden, the ECB has a more complicated task, having to ‘oversee’ a bunch of countries. Both central banks have an exclusive mandate: “Price stability”. While in Sweden that is understood as 2% inflation, in the EZ it is something slightly lower. Nevertheless, the two ‘countries’ central banks acted in tandem, tightening as a reaction to higher than target inflation due to oil price shocks.