Central banks and monetary belligerence

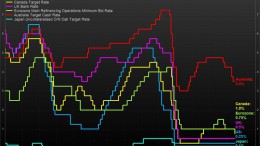

MADRID | All the “Great Depression” stories show how both the governments’ blindness and central banks made the crisis last longer. So it does makes sense that in the current crisis both governments and central banks have been active to take measures, although not necessarily successful and effective. However, the ECB has been less belligerent than other bankers and its members don’t hold homogeneous positions.