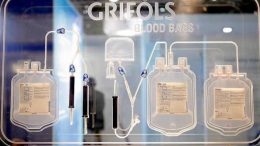

Moody’s withdraws Grifols ‘B3’ corporate rating and ‘B3-PD’ probability of default rating among others

Bankinter | Moody’s has stopped rating Grifols’ debt because it believes it has “insufficient or inadequate” information to maintain its ratings. Thus, the agency withdraws Grifols’ corporate rating of ‘B3’ and the probability of default rating of ‘B3-PD’ and the other ratings (senior unsecured debt, secured debt and bank credit lines). Prior to the withdrawal, the outlook was ‘stable’ for all ratings. The Company continues to work with S&P and…