Mr Sinn on EMU Core Countries’ Inflation

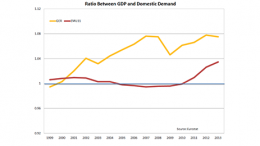

By Franceso Saraceno | Where [President of CESifo Group Hans-Werner Sinn and I] disagree is on how to trigger the demand-driven boom. Mr Sinn expects this to happen thanks to market mechanisms, just because of the reversal of capital flows that the crisis triggered. He argues that the capital which foolishly left Germany to be invested in peripheral countries, being repatriated would trigger an investment and property boom in Germany, that would reduce German’s current account surplus. This and this alone would be needed. Not a policy of wage increases, useless, nor a fiscal expansion even more useless. Problem is, the data speak against Mr Sinn’s belief. Since the crisis hit, capital massively left peripheral countries, and yet this did not fuel domestic demand in Germany.