Two weeks ago I received a request from Prof Sinn to make it known to my readers that he feels misrepresented by my post of September 29. Here is his very civilized mail, that I publish with his permission:

Dear Mr. Saraceno,

I have just become acquainted with your blog: https://fsaraceno.wordpress.com/2014/09/29/draghi-the-euro-breaker/. You misrepresent me here. In my book The Euro Trap. On Bursting Bubbles, Budgets and Beliefs, Oxford University Press 2014, and in many other writings, I advise against extreme deflation scenarios for southern Europe because of the grievous effects upon debtors. I explicitly draw the comparison with Germany in the 1929 – 1933 period. I advocate instead a mixed solution with moderate deflation in southern Europe and more inflation in northern Europe, Germany in particular. In addition, I advocate a debt conference for southern Europe and a “breathing currency union” which allows for temporary exits of those southern European countries for which the stress of an internal adjustment would be unbearable. You may also wish to consult my paper “Austerity, Growth and Inflation: Remarks on the Eurozone’s Unresolved Competitiveness Problem”, The World Economy 37, 2014, p. 1-1, http://onlinelibrary.wiley.com/doi/10.1111/twec.2014.37.issue-1/issuetoc, in which I also argue for more inflation in Germany to solve the Eurozone’s problem of distorted relative prices. I would be glad if you could make this response known to your readers.Sincerely yours

Hans-Werner Sinn

Professor of Economics and Public Finance

President of CESifo Group

I was swamped with end of semester duties, and I only managed to read the paper (not the book) this morning. But in spite of Mr Sinn’s polite remarks, I stand by my statement (spoiler alert: the readers will find very little new content here). True, in the paper Mr Sinn advocates some inflation in the core (look at sections 9 an 10). In particular, he argues that

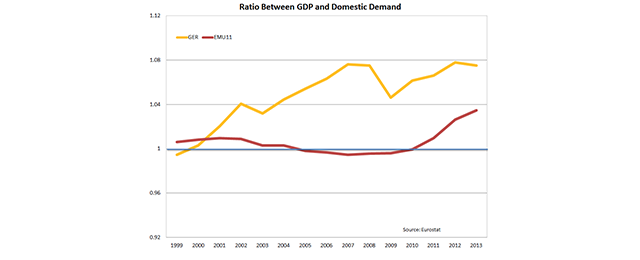

What the Eurozone needs for its internal realignment is a demand-driven boom in the core countries. Such a boom would also increase wages and prices, but it would do so because of demand rather that supply effects. Such demand-driven wage and price increases would come through real and nominal income increases in the core and increasing imports from other countries, and at the same time, they would undermine the competitiveness of exports. Both effects would undoubtedly work to reduce the current account surpluses in the core and the deficits in the south.

This is a diagnosis that we share But the agreement stops around here. Where we disagree is on how to trigger the demand-driven boom. Mr Sinn expects this to happen thanks to market mechanisms, just because of the reversal of capital flows that the crisis triggered. He argues that the capital which foolishly left Germany to be invested in peripheral countries, being repatriated would trigger an investment and property boom in Germany, that would reduce German’s current account surplus. This and this alone would be needed. Not a policy of wage increases, useless, nor a fiscal expansion even more useless.

*Continue reading at Francesco Saraceno’s blog.

Be the first to comment on "Mr Sinn on EMU Core Countries’ Inflation"