Halting QE= Active monetary asphyxiation?

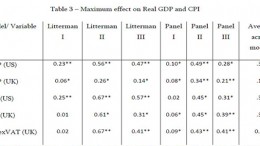

NEW YORK | By Benjamin Cole at Historinhas | The recent historical and empirical record strongly suggests central bank quantitative easing (QE) works. The riddle is whether both the Japan and U.S. economies will slip into stagnation again without QE, as long as there is a global glut of capital holding down interest rates, and inflation is dead—or even if inflation is near 2 percent on the PCE deflator, the putative Fed target. The riddle might even be reframed: When central banks do not conduct QE, are they actively engaged in monetary asphyxiation?