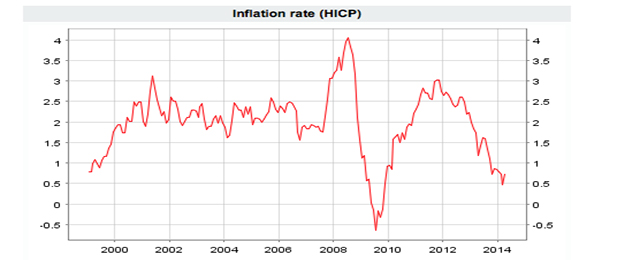

With annual inflation in the 18-nation EZ at 0.7%, well below the European Central Bank’s target of 2% over the medium term, pressure is building on the ECB to consider additional stimulus measures. ECB’s top economist, Peter Praet, in an interview with German newspaper Die Zeit, said the central bank is preparing a number of measures to counter low inflation, mentioning a negative rate on deposits as a possible option in combination with other measures.

It would be negative to just weigh up (in a short-term approach) exchange rates; in other words, he believes part of Euro’s soundness comes from increasing international investment in the EZ. Exchange rate is not a objective in single monetary policy but agrees it is relevant as impacts on inflation, although can clash with the ECB’s price stability target. Mr Weidmann highlighted that member states must reinforce competetive structures in order to maintain growth and employment.

AstraZeneca was also making big headlines on Monday. Shares dropped by nearly 14% in London exchange market opening after the decline of €8bn bid offer from Pfizer. New approach from american labs value AstraZeneca stocks in 55 pounds (50 pounds in May 2 offer). Pfizer has shown its interest to acquire the pharma since early 2014 and made three different offers so far but none would follow this one, they warned. AstraZeneca top management pointed out “the new offer undervalues the company and the attractive prospects.” Chairman Leif Johansson said they would accept an offer worth 58 pounds per share.

Be the first to comment on "Market chatter: Weidmann says ECB must closely watch euro"