Rich countries usually hold more assets than liabilities to their external position. Their accumulating capital needs to be reinvested and they do it by searching for profitability beyond their borders.

Profits become national income for the country exporting capital, which, however, is not included in the GDP, which is internal production by definition. This income, like immigrants remittances, counts for the Gross National Product (GNP), whose main difference with GDP is just that net income coming from national sources abroad.

For instance, the money that Santander bank obtains from its external investments and then brings back again to Spain in terms of profits, or the money an engineer earns for completing some public works in a foreign country and afterwards transferring to his current account in Spain, go to national income. Then foreign income are substracted from that national one and the result, which makes the net external income, is taken into account for GNP.

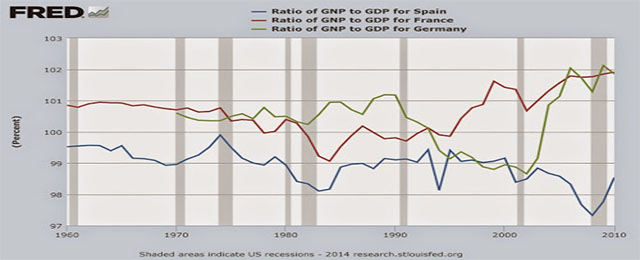

The picture above shows the accumulated effects of this GNP compared to GDP. Considering Spain against significant countries such as France or Germany, its ratio GNP/GDP has always been under 100. It also illustrates a trend to decrease until year 2010, according to last available figures in St. Louis Fed’s database.

All this means that Spain holds a red net external income, paying more than receiving for factors of production used internally. Therefore, Spain is a country that needs foreign capital, and that is why it has build up a net external debt by 100% of GDP. On the contrary, France shows an increasing trend of its GNP/GDP ratio. This is because it can generate enough savings over the years in order to stand over its investments needs, which at the same time leads France to seek for alternative profitabilities in other countries.

The virtue of saving

Germany’s evolution proves to be peculiar. Until the reunification in 1990 is was a net capital exporter. The reunification meant an additional demand of resources which significantly reduced that external financing capacity. However since year 2000 when the euro was introduced, it is very noticeable the GNP/GDP’ s ratio going upwards, basically because Germany has increased its financing capacity to to extent of surplus.

Behind these different positions is the “virtue of saving”. It is absolutely fair to reward this effort. Germany’s having a net external position at 100% of GDP is because of its effort. This would be the naive Austrian view, which probably does not consider Adam Smith.

Adam Smith wrote its works partly to fight against the mercantile attitude that told the wealth of a country was not the welfare of its citizens but the accumulation of external capital. As gold was considered the universal currency, this capital was even more solid if built up in terms of gold. Smith showed that economic welfare was rooted, however, on freedom. A freedom which may be very limited in Europe since the central bank is subjected to the dominant country’s instructions.

The euro’s owner

Is Germany market-focused? Similar to pre-Smith rich countries it is increasingly accumulates euros. This would not affect Spain if Spain did not have to use euros or if Germany’s external investments came to Southern European countries. But neither of both is happening. Germany rules the monetary policy that is in its interest but says all is due to its efforts. Nobody discusses it. What is to be discussed is that the country is at the same time “owner of the euro.”

Considering again Germany’s external income going upwards since year 2000, it is partly due to accumulating loans to Spain and other countries in order to finance the real state boom. The bubble which damaged Spain so much is not only a responsibility of debtors but also of creditors who should have guessed this accumulation did not mean a good risk management.

Debts that grip markets today are bad debts to a great extent (this is a risk for Germany) because of the harmful management of euro, which has been very appreciated for Germany’s interests to maintain the price of its foreign assets. While registering a positive balance of payments by a 6% of its GDP, and an accumulated external capital by 100%, why should they change their view?

Germany’s risk, very wisely controlled until now, is that indebted countries go bankrupt, although this is not a minor danger for debtor nations either.

When a country does not cease to make external surpluses, it generates parallel deficits in others. These gaps are corrected by means of a rate exchange appreciation- depreciation or by reinvesting the surplus in the countries in deficit. Neither of which happened in the euro zone.

The third way is to rebalance prices between both countries, to perform what is called an internal devaluation. This will not work either if the country in surplus reduces even lower its internal costs.

Be the first to comment on "Is Germany the euro’s owner?"