70% of Stoxx600 firms see profit hikes

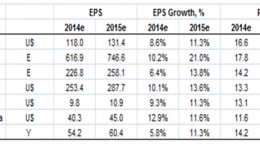

MADRID | The Corner | Reporting season in Europe is beginning. Over half the Stoxx600 companies that already showed results surpassed expectations. Profits grew for 70% of this businesses and the average rise was of 9%. European markets’ upward trend being less mature than American’s may point at a EuroStoxx higher appreciation potential. It gains importance as performance results keep looking up and prices context allows EZ companies to rise EBITDA margin from current 15.2% to prior years levels (above 16%).