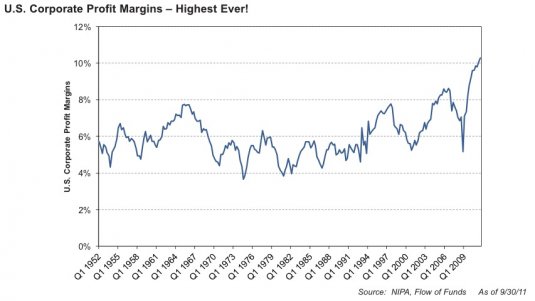

By Luis Arroyo, in Madrid | In 2011, corporate profits in the US have been exceptionally high. According to the accounts of S&P 500 companies, or according to the national accountancy, business margins have risen more than ever before.

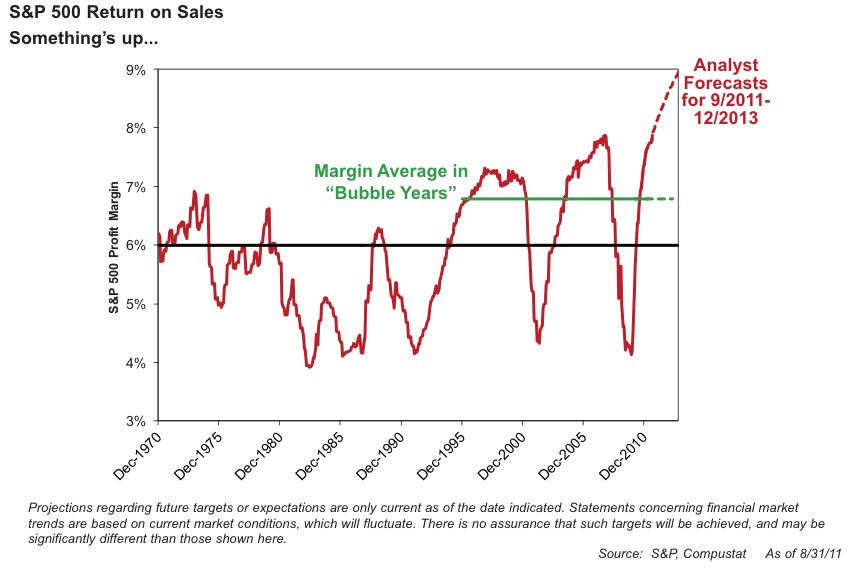

However, the consensus on Wall Street says that they will continue to rise, so the PER rate (price per earnings) is still low: therefore, the stocks will go up like a shot. In the graph below, data predict an increase of profitability per share, despite its current record level.

James Montier here pinches this baseless optimism. He sort of dismantles the counterparts of those expectations.

James Montier here pinches this baseless optimism. He sort of dismantles the counterparts of those expectations.

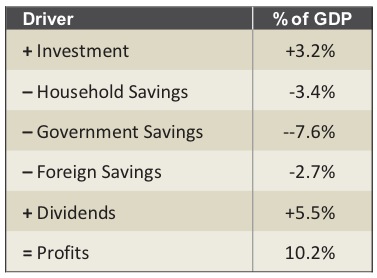

According to the national accountancy, profits are a part of the total income. If from total income we take off the other ingredients, Profits = Total Income -Personal income -State income -foreign income. But total income is the total result from spending and savings: it follows that profits are = total spending -savings in all the other sectors.

From here one concludes that that 10.2% growth in profits have these counterparts: an investment increase of 3.2%, a decline in personal savings of 3.4%, a decline in government savings of 7.6%, and a decline in foreign savings of 2.7%, to which we must add a 5.55% increase in dividends.

The most important contribution, then, is the increase in Treasury deficit by 7.6%. When the US begins to cut down its public deficit, companies will have to find another source of profits. This will be achieved either through personal consumption or investment. But of course, it seems unlikely that in the short-term profits will continue rising.

This matches a scenario of high profits with companies making an exceptional level of savings, rather than investing (which is why unemployment figures are going down so slowly).

I am not trying to imply that government spending is good, but only that when a country cuts it, there is huge unemployment unless there is a substitute element that increases spending. That spending should come from the private sector, investment financed via profitable interest rates and expectations of a demand about to become more dynamic. You cannot adjust a deficit without a compensatory policy, which can only be carried out by a central bank.

Be the first to comment on "US corporate profits are Keynesian"