Jefferies | The Bank of Spain announced the intention to gradually implement a 100bp CCyB for the banks, alongside a revision of the methodology through which the buffer is set. The announcement should not come as a surprise, given recent debate during the 1Q24 earnings season. We see a manageable impact from the higher capital requirements, and no immediate risk to the banks’ stated CET1 ratio targets or capital distribution plans.

On the path towards a 100bp CCyB. Bank of Spain announced today the launch of the procedure to revise the framework for setting the countercyclical buffer in Spain, and the intention to establish a positive CCyB rate from October 2024 (link to release here). The Bank intends to set the CCyB rate at 0.5% from 4Q24 (to be applicable from 4Q25). Subsequently, depending on the level of cyclical systemic risk in the country, the Bank will contemplate raising the CCyB rate to 1% from 4Q25 (to be applicable from 4Q26). The process will therefore require 2 separate decisions, and Bank of Spain has the flexibility to revise the plan announced today based on information that will arise during the process.

A public consultation was also launched today for the revision of Bank of Spain’s methodological framework for setting the CCyB. The most relevant change proposed is the association of a CCyB rate of 1% with a standard level of cyclical systemic risk, while under the old methodology, a positive CCyB would only be activated in the event of high cyclical systemic risk. The Bank argues that a positive CCyB rate in a standard cyclical risk environment will help ensure that the provision of bank financing to the real economy is more stable throughout the cycle.

The announcement today should not come as a surprise; In fact, the potential implementation of a positive CCyB was a recurring topic during the 1Q24 reporting season for the Spanish banks, with most management teams seeing the capital impact manageable in the context of their current CET1 position and stated CET1 ratio targets.

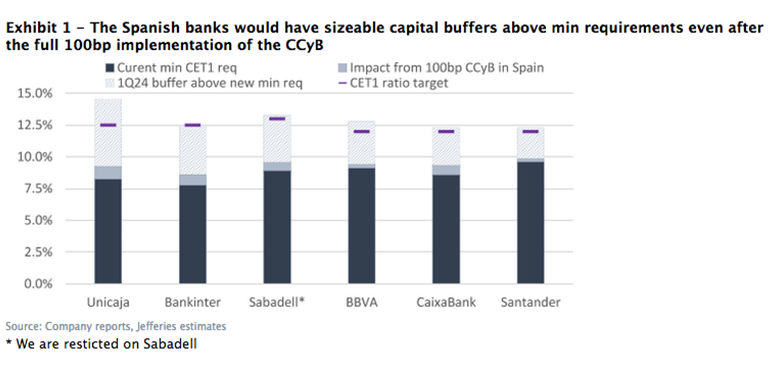

We do not see any meaningful risk to stated CET1 ratio targets or capital distribution plans. We present our estimated capital impact from the 2-step implementation of the CCyB in Exhibit 1 above. The impact ranges from 100bp for Unicaja, to 24bp for Santander, given the relative size of Spanish exposure in the geographical mix of the banks. Even pro forma of the full-implementation of the buffer, the Spanish banks would be left with sizable buffers above the minimum requirement their capital position as of 1Q24, ranging from 245bp for Santander to 525bp for Unicaja. We also do not see imminent risks to the banks’ stated CET1 ratio targets: Santander would have the narrowest buffer to its >12% CET1 ratio target, but still supportive at 215bp, while Bankinter would have the most room given a 390bp buffer between the new minimum requirement and its 12.5% target. We also note the lengthy implementation of the new CCyB requirements – with the first 50bp needed to be met by 4Q25, and the remaining 50bp by 4Q26. We expect the Spanish banks to deliver strong capital generation during this timeframe, and do not see any immediate downside risk to our estimated capital distributions.