Yield gap growing –For how long?

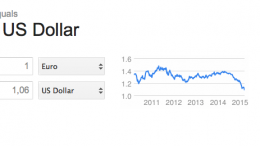

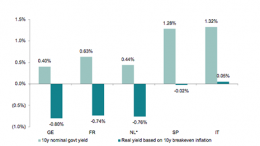

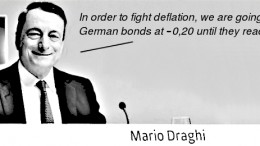

The Corner | March 11, 2015 | The euro sinked to 12-year lows on Wednesday due to the ECB’s money printing –which is pushing yields down (German 30-year government bonds are now lower than those on U.S. two-year paper), and increasing expectations of a rates hike on the other side of the Atlantic. ECB’s Governing Council member Ewald Nowotny insisted that negative bond yields in the euro area probably won’t remain for long.