Eurozone credit lending sees first rise since 2012

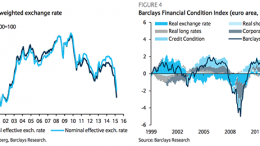

The Corner | April 29, 2015 | Is the eurozone’s private sector finally turning a corner? For the first time in three years, lending to households and firms rose in March (0.1% y-o-y), European Central Bank data showed on Wednesday, partly thanks to the QE iniciative.