Volatility in the EGB markets, particularly on Bunds, has increased again over the past few days, with the 10y German yield moving up about 40bp to 85bp. However, the fact that periphery versus core spreads as well as breakevens have remained broadly unchanged suggests the sell-off was mainly originated by a pure “rates movement”. As was the case in May, technical factors rather than effective bond liquidation are likely to be the cause of the sell-off, as suggested also by the sharp increase in Bunds future volumes.

In the press conference after the ECB’s June meeting, President Draghi commented on the significant increase in EGB market volatility, particularly Bunds. In his view, it is related to improved growth/inflation expectations, as well as to technical factors, and he remarked that the Governing Council was unanimous in that it should “look through these developments” and maintain a steady monetary policy with no need to deviate from the current programme. Importantly, he warned that markets should get used to higher volatility since, at very low levels of interest rates, asset prices tend to show higher volatility. He pointed out that side effects in terms of financial stability risk should be addressed with macro-prudential instruments.

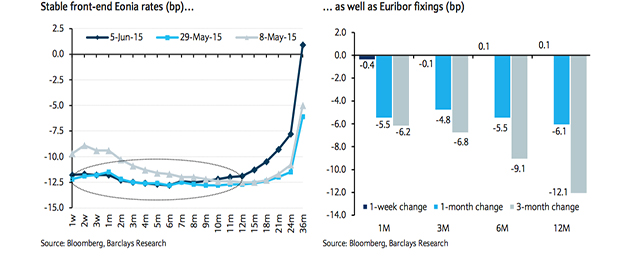

It is noteworthy that in the euro money markets, reference rates (Eonia and Euribor fixings) as well as rates up to about 1y have been basically immune to the new round of high volatility, and so have not affected the ECB’s extremely accommodative monetary policy stance. This is because such rates are more sensitive to liquidity conditions: the abundant liquidity surplus of about €300bn over the past few weeks and expectations of a further increase in the next few months represent important “protections” for the very front end of the money market curves.

Be the first to comment on "Resilient Eonia fixing, fragile long Eonia rates"