Many important assets have been trapped in broad trading ranges in recent years. BoAML’s experts give some examples:

• US Treasury 10-year yield: between 1.5-2.5% for 3 years

• German Bund 10-year yield: 0-1% for 3 years

• US dollar index (DXY): 93-103 for 21⁄2 years

• Euro-dollar: between $1.05-1.15 for 21⁄2 years

• Yen-dollar: between ¥100-120 for 4 years

• Gold: $1100-1400 for 4 years

• VIX: 10-25 for 2 years

As analysts report these trading ranges in bonds, currencies & volatility have been sustained in the past 18 months “despite substantial political upheaval, the onset of fiscal stimulus (and fiscal policy has been eased globally despite the lack of action by the Trump administration), and a synchronized global recovery”. They explain:

The inability of yields, the US dollar & volatility to break out reflects the inability of the economic cycle to generate strong growth & inflation. The secular backdrop of excess Debt, aging Demographics, technological Disruption continues to cap inflation and interest rates.

If there was ever a year inflation was set to rise it was 2017: economic recovery is in its 8th year, strong global manufacturing recovery, Europe/China benefitting from big credit/fiscal easing, oil prices up significantly from 2016, corporate profits soaring potentially boosting wages, unemployment very low in US/Japan/Germany, minimum wages on the rise, and so on. And yet inflation has significantly underperformed expectations in 2017.

BoAML’s analysts attribute this to three secular trends. First, excess debt encourages saving, not spending: the Institute of International Finance just announced that global debt hit an all-time high of $217tn or 327% of global GDP in Q1. Second, because aging demographics encourage saving not spending: even in the US, where the demographics are in better shape than in Europe & Japan, working population growth in the past decade has shrunk quickly from 1.3% to 0.5% per annum, putting downward pressure on inflation. Third, because robotics, automation, artificial intelligence, the daily disruption of technology are all killing wage expectations; corporations continue to emphasize cost-cutting over risk-taking and wide swathes of the labor market see that their ability to maintain wages & incomes are under enormous threat from technology.

The profound implications of technological disruption may ultimately require profound policy changes such as: making robots living entities so they can be taxed, governments introducing living wages, significantly higher taxation of Silicon Valley profits, and so on. But for investors in 2017 it simply means that the desire to rotate aggressively from deflation to inflation has been curbed.

Note also how long-term GDP forecasts in the US, Japan & Germany continue to fall. The current estimate of US long-term potential growth as surveyed by Consensus Economics is 2.1%, the lowest forecast of the past 25 years, despite massive monetary stimulus & a cyclical recovery. Economists believed potential US growth was above 3% just ten years ago.

Meanwhile, the long-term GDP forecasts in Germany have fallen to 1.3% and in Japan to 0.8%. Back in 1990 economists predicted Germany’s potential growth rate was 3%, Japan’s 4%.

As a conclusion, experts summarises:

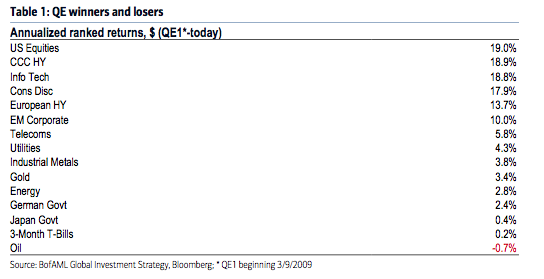

Thus investors in 2017 have been forced to witness the “Amazonification” of Main St entrenching the “Japanification” of Wall St. Low inflation on Main St means low interest rates on Wall St. And the leadership of the two asset classes that have most definitely been in secular uptrends, equities & corporate bonds, continues to be “deflationary”.Take a look at a performance table of winners and losers since QE was first introduced in early 2009 when the era of maximum liquidity and minimum growth began. The winners have been US & global stocks, tech stocks, growth stocks, high yield bonds, Emerging Market bonds. The losers have been oil, cash, government bonds, resources, value stocks, Japan & European peripheral assets. This leadership has resumed in 2017.