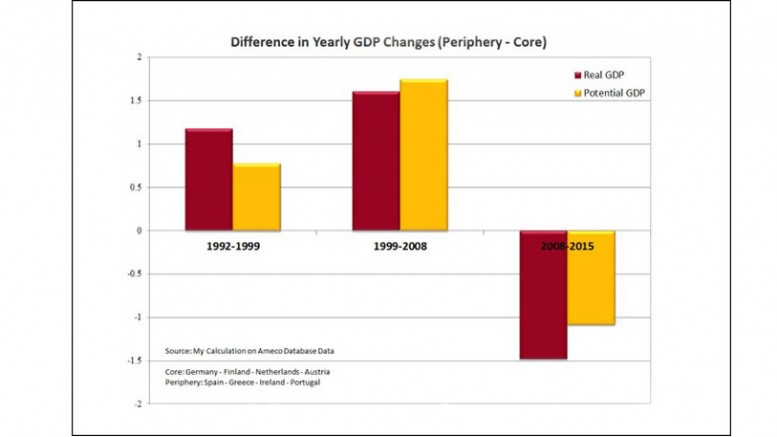

Francesco Saraceno | I computed real GDP of the periphery (Spain-Ireland-Portugal-Greece) and of the core (Germany-Netherlands-Austria-Finland), and then I took the difference of yearly growth rates in three subperiods that correspond to the run-up to the single currency, to the euro “normal times”, and to the crisis.

Let’s focus on the red bar: until 2008 the periphery on average grew more than 1% faster than the core, a difference that was even larger during the debt (private and public) frenzy of the years 2000. Was that a problem? No. Convergence, or catch-up, is a standard feature of growth. Usually (but remember, exceptions are the rule in economics), poorer economies tend to grow faster because there are more opportunities for high productivity growth. So it is not inconceivable that growth in the periphery was consistently higher than in the core especially in a phase of increasing trade and financial integration;

We all know (now; and some knew even then) that this was unhealthy because imbalances were building up, which eventually led to the crisis. But it is important to realize that the problem were the imbalances, not necessarily faster growth. In fact, if we look at the yellow bar depicting the difference in potential growth, it shows the same pattern (I know, the concept of potential growth is unreliable. But hey, if it underlies fiscal rules, I have the right to graph it, right?).

During the crisis the periphery suffered more than the core, and its potential output grew less. This is magnified by the mechanic effect of current growth that “pulls” potential output. But it is undeniable that the productive capacity of the periphery (capital, skills) has been dented by the crisis, much more so than in the core. Thus, not only we are collectively more fragile ; on top of that, the next shock will hurt the periphery more than the core, further deepening the divide.

The EMU in its current design lacks mechanisms capable of neutralizing pressure towards divergence. It was believed when the Maastricht Treaty was signed that markets alone would ensure convergence. It turns out (unsurprisingly, if you ask me) that markets not only did not ensure convergence. But they were actually a powerful force of divergence, first contributing to the buildup of imbalances, then by fleeing the periphery when trouble started.

Markets do not act as shock absorbers. It is as simple as that, really.