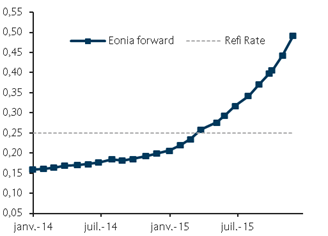

The ECB left its policy interest rates unchanged, as widely expected, and confirmed that its forward guidance remains in place: interest rates are expected to remain at present or lower levels for an extended period of time. ECB President Mario Draghi used a “firmer” language on the ECB’s readiness to act, as the recovery remains moderate and fragile and risks of low inflation for long persist.

He clarified in the Q&A section that the two main contingencies that would prompt the ECB to take further action would be: 1) unwarranted tightening in money markets; and 2) a worsening medium-to-long term outlook for inflation. He also stated that the “firmer” language used in the introductory statement was intended to address and mitigate these risks.

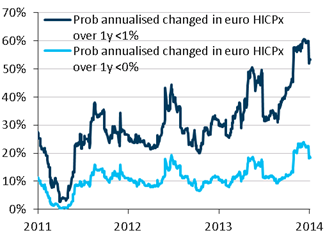

We currently project the euro area headline HICP inflation rate to reach a low of 0.7% y/y in February. However, significant negative base effects are in the pipeline from energy and food prices for January and February, and we cannot rule out lower prints. Furthermore, the competitiveness adjustment at play in several member states implies that inflation forecasts are less reliable than in the past, and we cannot rule out further downside revisions for medium-term expectations. As a consequence, we think the ECB might be forced to act should inflation and inflation projections fall further than currently expected.

When asked about which kind of monetary policy instruments the ECB would use to address those contingencies if they were to materialize, President Draghi remained as vague as in the past by saying that “all of the instruments allowed by the Treaty” would be considered, and the specific instrument(s) to be used would be tailored to the type of contingency. When asked about the risks of low inflation for long, and the possibility of a Japan-style scenario, President Draghi was categorical in dismissing that the EA was anything like Japan in the 1990s.

He responded that: first, the ECB took timely action early in the crisis; second, the AQR and stress tests will address any remaining concerns about the balance sheets of European banks; third, the conditions of EA corporates balance sheets are considerably stronger than the Japanese corporates in the 1990s; and fourth, inflation expectations for Japan were clearly not well-anchored, which has not been the case for the EA throughout the crisis. We broadly agree with these arguments, and we consider that the risk of a Japan-style deflation developing in the EA is very low.

On the upcoming AQR and stress test, President Draghi admitted that while there are some concerns about the effect of the AQR on banks’ credit tightening in the very near term, he was clear that the net gain from this assessment is evident. By year-end, he expects a strengthened banking system to set the foundation for better credit dynamics and economic growth. We consider the risk of a temporary tightening of credit conditions due to the Comprehensive Assessment (AQR+stress tests) to be real.

On the next steps, as we stated in our previous ECB preview (ECB preview: No major announcement expected), we believe that targeted liquidity measures (such as conditional LTROs) to ease credit constraints for SMEs still appear to be under consideration, although the Governing Council has not decided yet how it would be implemented.

Last month, President Draghi noted that any new measures would have to be designed to discourage banks from using these for carry trades with government paper. Instead, their design (possibly also a funding-for-lending scheme) should ensure that the funds arrive as additional bank loans in the real economy. Beyond the measures described above, we do not expect the ECB to ease policy further under our macroeconomic scenario of a slow but sustained economic recovery and no further drop in inflation, very similar to the ECB’s staff macroeconomic projections.

However, the downside risks to this scenario are real. We therefore continue to attach a non-negligible likelihood to further policy easing, either through securities purchases (QE including government bonds), or even negative rates.

Be the first to comment on "ECB: Attentive to money market conditions and inflation outlook"