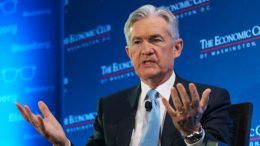

Fed members talk of “patience”, first cut not likely until end of year or even 2025

Banc March: Round of statements from Fed members, where the word “patience” has been recurrent in their speeches and they delay the first cut to the end of the year and even 2025. The Atlanta Fed president believes that inflation is too high and does not consider it appropriate to lower the cost of money until the end of the year. He also said he was open to raising rates…