There’s a new monetary theory doing the rounds here which claims to be revolutionary: the Modern Monetary Theory (MMT. Not to be confused with the Market Monetary Theory). I agree with some of its points. But when some of its supporters cross the boundaries of logic and take advantage of it to say the state deficit and debt are not important – that they don’t have damaging consequences – the theory becomes a huge deliberate fallacy.

The part of the theory with which I agree is its analysis of what money is, the creation of money, and from where its circulation arises. I have no objections to the fact that money is money because it’s accepted by everyone, and hence the importance of public money which is monopolised by the state. It’s difficult to imagine that money issued by a private entity would be as universally well accepted as fiduciary money today. Confidence in money depends on confidence in the state which issues it. A test of confidence was the massive shift towards money- the dollar when the crisis started in 2008. Everyone wanted liquidity in dollars or Treasury bonds.

For that reason I think Stuart Medina’s analysis, “Chartalismo”, in his blog (divided into various posts, is excellent until it reaches the lines of argument I refer to. The MMT theory, which has also been called “zero unemployment,” is based on the law of accounting compensation which there is between the government’s deficit (excess) and the private sector’s corresponding excess (deficit). For these people, in order for the private sector to save – and normally, they say, it does save – the state necessarily has to unsave: spend more than it receives.

So there can only be a public surplus if there is a private deficit! That is a massive lie, as we will see. For this reason, when the private sector is indebted and needs to save to pay these debts, the only thing the state can do is to pay out money to the non-public sector. Which effectively amounts to a transfer of money from one account to another via the Central Bank.

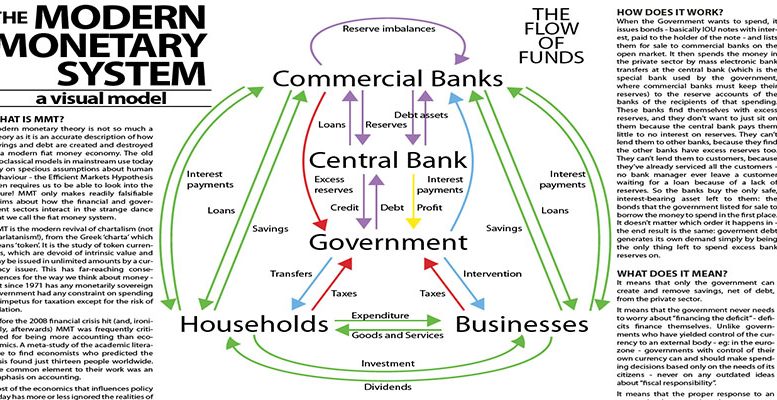

The money would be spent by increasing public spending. So families and companies could quickly start to consume again, invest and work. The state’s only concern would be that if too much money is issued then it will fuel inflation. Another “revolutionary” aspect of the MMT is that instead of the state issuing debt, this will be substituted by the simple flow of money between the Central Bank and the state. The state should not issue debt which becomes a fictitious burden, since its monetarisation would end that. The state has an account in the Central Bank, with a zero interest rate, which it can use to deposit money or take out funds and be in credit or in debt.

This is incredibly bold. Responsable citizens would always prefer the state to issue debt, for transparency reasons. Even if it’s just to watch the trend in the yield curve for different maturities and how it is accepted by creditors. One thing is for the state to have a liquid account with the Central Bank with a zero interest rate, and quite another that it is not transparent and takes money when and whenever it wants. But let’s look at these excessive simplifications which are not clearly explained.

In the first place, there are not just two economic sectors. Apart from the ones mentioned, there is an external sector and whether it is a creditor or debtor is very important for the economy. If the external sector holds our country’s debt, the size of this can influence our creditors’ confidence depending on how we play the “simple” game of putting in and taking out money from the Central Bank to give to the private sector. Even more so if this debt is in foreign currency which becomes more expensive when it devalues.

And secondly, there is no guarantee that money issued like this and put into circulation by the government via a hike in public spending is efficiently spent. For it to be so, it should be spent with enough productivity in comparison with our foreign competitors so that it’s not imports or the déficit and foreign debt which rises. Let’s take Spain’s case. In 2008, it had an external deficit of 10% of GDP and 100% debt. If you pour cash into it by increasing public spending to the point where unemployment is at zero, the most likely thing is that the external deficit rockets. At home, there is an uptick in consumer spending and imports, while money is invested in low productivity lines (either public or private) which would indeed create a lot of jobs, but they would be unsustainable.

And thirdly, it is not true that the private sector usually saves. Companies normally take on debt to invest. During the bubble, families took on debt to buy houses at exorbitant prices. While the state was saving and cutting its debt to 36% of GDP, the private sector was happily taking on debt.

What is true is that when the crisis broke out it created a problem. Liquidity disappeared amid the panic and the Central Bank had to attend to this. Furthermore there were solvency problems all around, particularly in the banking sector. It had jumped through all the safety hoops and found itself with a load of doubtful assets and insufficient capital, creating a systemic panic which needed to be curbed as soon as possible.

It seems to me that the unlimited account which the state has with the Central Bank is not sufficient to deal with so many problems.

Internally, the natural contraction in demand when a bubble bursts can be offset by an increase in liquidity, for which there is no need to invent a new theory with a new acronym : it’s already invented and the distribution of money via public spending is called “Helicoper Money”.