Jefferies Equity Research| 4% PBT beat versus consensus in 1Q 24, driven by better income and costs, only offset by a small miss on impairments. The print confirms NII trends are still positive (up 1% quarter-on-quarter), despite flat growth, but margin dynamics proving supportive (cost of deposits only up 3bp quarter-on-quarter, likely at peak). Costs were 3% lighter than consensus and trending better than the LSD-MSD year-on-year growth guidance provided at 4Q. Impairments trending at 39bp (versus FY24 guidance of 35-40bp).

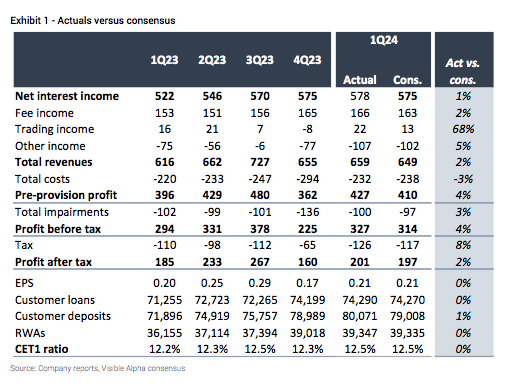

Bankinter reported net income of €201m, which was 2% above consensus of €197m. PBT was a 4% beat, with pre-prov profits also a 4% beat. Income was a 2% beat and costs a 3% beat.

NII was 1% above consensus, up 1% quarter-on-quarter and up 11% year-on-year. Asset yields were flat versus 4Q23 levels, with the cost of deposits only ticking up slightly in the quarter (+3bp).

Net fee income was a 2% beat. Trading income of €22m compares with consensus of €13m. Other income was a 5% miss versus consensus and includes a €95m charge for the extraordinary tax on banks (in line with guidance).

Total costs were 3% lighter than consensus.

Total impairment charge (including gains/losses on asset disposals) of €100m compares to consensus of €97m charge. The 1Q24 implied cost of risk of 39bp is at the higher end of the FY24 guidance of 35-40bp. The NPL ratio was up 12bp in the quarter to 2.23% (driven by corporate NPLs).

Customer loans were in line with consensus and flat quarter-on-quarter. Deposits were 1% higher than consensus and up 1% quarter-on-quarter.

Capital: CET1 ratio of 12.5% in line with consensus, with both CET1 and RWAs in line.