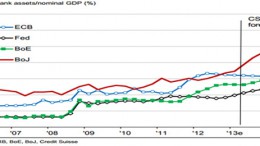

Shot down plane = Bund at 1.14%

MADRID | The Corner | Thursday was shelter assets’ day due to the tragedy of the Malaysian Airlines passenger hit by a missile in Ukraine, the hardening of the Russia sanctions and the worsening of the conflict in Palestine, analists at Bankinter commented. The Bund reached a new historic low of 1.14% (the previous record was 1.17%) and the yen and Swiss franc appreciated up to approx. 137 and 1.214 respectively.