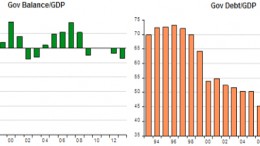

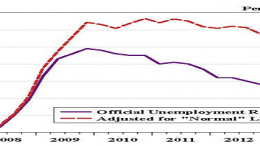

Economic Recovery: “Never reason from the previous peak”

SAO PAOLO | By Marcus Nunes | In “The current state of the US economy explained in one chart”, Mark Perry shows the chart above. As I argued in “The previous peak is not the appropriate benchmark” (Parts 1 & 2), just because you´ve reached or surpassed the previous peak does not mean you have achieved a complete or full recovery.