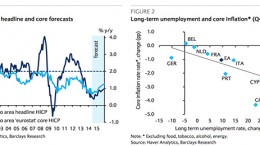

Growth and inflation outlooks diverging

LONDON | By Antonio Garcia via Barclays | Stronger-than-expected July PMIs suggest that the growth outlook is likely to improve in Q3 and are consistent with our forecast of 0.4% q/q. EA public debt levels have reached a new peak in Q2 14 at 96.4% of GDP, with three of the four largest EA economies above the EA average. We now expect July HICP inflation (next week) to edge down to 0.4% y/y and August inflation to decline further, to 0.3% y/y.