From UBS analysts’ Wednesday comment:

Signs of European banks inching towards easier credit conditions…

The ECB bank lending survey for Q2, released recently, shows tentative signs of improvement. Banks are easing (just) credit availability for mortgages and consumer credit and have stopped tightening credit availability for SMEs. Q2 was the first time that we have seen this since 2007.

Europe is different from the US

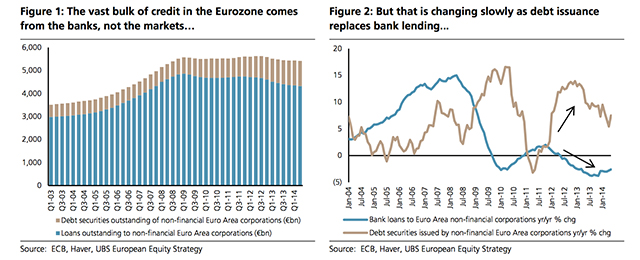

When examining which sources corporates use to access borrowing, the picture in the Eurozone is very different from that in the US. Eurozone corporates have approximately €5.4trn of corporate debt outstanding – just under 80% of that is from bank lending and 20% from corporate bond markets (Figure 1). In the US the dependency is completely the other way round. In this sense, getting banks to lend is key for restoring credit availability to the Eurozone system.

But things are changing…slowly

Market forces are at work and the debt issued in corporate bond markets is increasing rapidly and taking share of the pie from traditional bank lending (Figure 2). Whilst bank debt still represents the vast bulk of lending, it has fallen from a peak of 87.6% in Q3 2008 when Lehman collapsed to 79.8% currently. Taking corporate debt issuance and bank lending together, credit is still falling, but by just 1.1% year on year in Q2 compared to -3.4% in 2013.

*See more here.

Be the first to comment on "Credit in Europe – is it finally set to turn?"