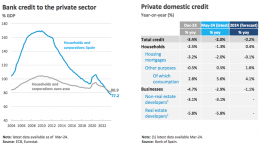

Stock of credit to Spanish resident private sector moderates fall rate

Caixabank Research | Households and corporate debt levels (including debt securities) remain below euro area averages in 4Q23. Both sectors have deleveraged in terms of GDP, reaching levels lowee than pre-pandemic ones. New mortgage production recovers in early 2024 with the change in interest rate expectations. New lending for consumption increases favored by improvements in consumer confidence, and credit for consumer durables, exceeding pre-COVID-19 levels. New lending to corporates grows…