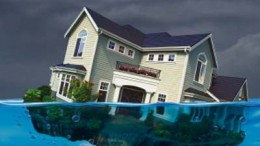

The best bailout for Spain

The Spanish tether already seems overstretched. On Monday, the national institute for statistics published fresh data confirming a forecast released days before by the country’s central bank, which warned of a contracting GDP: at -0.4 percent, records for the second quarter of the year were indeed 0.1 percent worse than for the first three months. Private consumption and investment have fallen, year on year rates of industrial prices have risen…