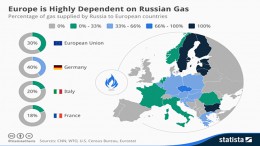

Can’t live without Russian gas (yet)

MADRID | The Corner | The EU released on Wednesday a target to improve energy efficiency by 30% as part of a package of climate and energy policy for 2030, and a measure that some considered “a gift to Mr Putin.” The truth is Europe says it is on the verge to impose sanctions to Russia for the downing of Malaysia Airlines Flight 17, although it has been reluctant to use US-stule sanctions in the past due to its high dependence on Russian gas -see this chart by Statista which shows the deep interconnection-. But there seems to be a way for the Old Continent to wear off any gas cuts if things gets really nasty: liquefied natural gas (LNG). For countries like Spain, it would be a golden opportunity.