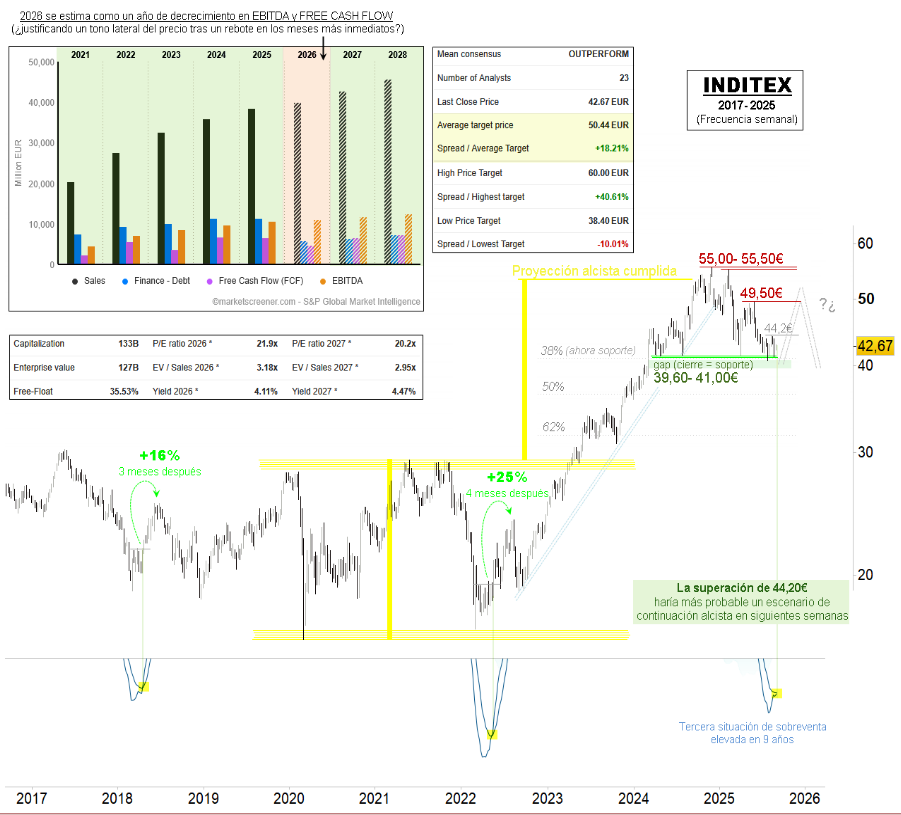

Renta 4 | On Thursday, it will present its quarterly results in an important technical situation. Since April last year, it has been forming a demand and support zone at €41, with a filter down to €39.60, where it presents the closing of a significant bullish gap. Technical indicators are reversing from exceeded levels, which favours a recovery process in the coming months, although the price would have to confirm a break above the €44.20 zone. The upside targets are at two levels, the first at €49.50 and the second in the historical highs zone, between €55 and €55.50. We believe that after this expected recovery process, there could be a bearish rebound next year, as the price lost its upward trend from 2022, reaching significant bullish projections. In addition, some of its key figures are expected to decline in 2026.

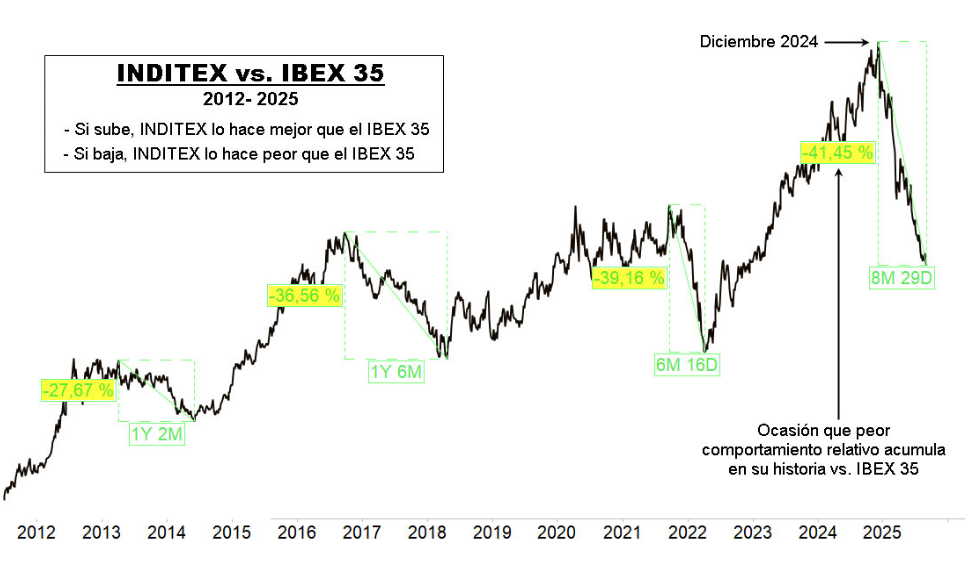

It is important to highlight the historically poor performance of the stock relative to its index, the IBEX 35. Since last December, it has accumulated a 41% relative underperformance, the largest in its history.

Recommendation: BUY above €44.20.