As BNP analysts commented:

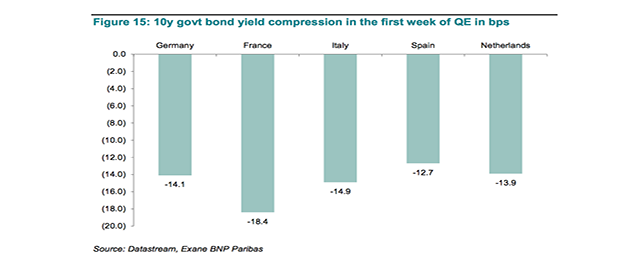

The chart above shows the fall in yields during the first week of ECB QE – where EUR9.751bn of sovereign purchases were made.

To put this into perspective, if yields were to fall by a similar amount each week the 10Y Bund yield would be -20bps – equivalent to the deposit rate that Draghi has identified as the potential limit to purchases – in around 4 weeks.

Clearly the linear relationship implied here need not hold. But in an environment where ECB buying is dominating the market, this will do nothing to reassure investors over the implementation of the programme.

The next leg of the policy debate, circling back to a potential ABS programme, under a regulatory regime that incentivises banks to create more securities with more favourable capital treatment, is still quiet. We think as Q2 gets under way, in the absence of progress on this front, the anxiety over QE implementation may will start to become a bigger consideration for investors.

Be the first to comment on "BNP sees risks in QE implementation"