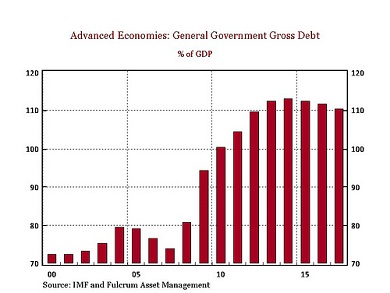

Financial Times‘ Gavyn Davies dissects a heterodox proposal to escape from the debt trap: central banks could just cancel the pile of public debt that these institutions held. Industrialised countries are actually asphyxiated under its weight–as reflected in the chart–even after having it cut down to 110 percent of GDP.

If the US Federal Reserve, the European Central Bank and the Bank of Japan agreed to write down those debts, their governments would immediately be relieved from their pressure.

There are some differences, of course. For instance, the Bank of England owns 25 percent of British sovereign debt, while the Fed holds 10 percent of US debt. But in all cases, these haircuts would help almost everyone else. Creditors would see default probabilities fall noticeably, non-creditors would discount reductions in future taxes, and long-term interest rates would drop. Competition to grab a piece of the savings cake for investment would relax, as governments’ finance needs would decrease.

The caveat, obviously, is the risk of inflation. Here is where austerity-obsessive types come in and start crying wolf about hyperinflation and bubbles, moral hazard and other touchy-feely concerns. True, the risk exists, but it isn’t automatic. Measures can be taken to diminish side effects. On the other hand, doing nothing about the amount of public debt governments have reached will push us all into long years of economic rehabilitation, defaults and poverty.

A central bank might not have sufficient assets or mechanisms to reclaim the money injected, that would be the real problem. Yet, it could raise interest rates on loans to the banking sector, and toughen collaterals’ conditions. Governments could introduce countercyclical fiscal policies, too, to cool down the economy.

Thus, the difficulties aren’t technical but political. What this would require is an efficient coordination of fiscal and monetary authorities.

Gavyn Davies mentions interesting bibliography references, but there is one he missed, in my opinion, Friedman’s “A monetary and fiscal framework for economic stability.”

In it, Friedman suggests a government and central government joint action to control the cycle in a way that public spending would be capped by the parliament. When faced with a recession and poor tax income, the government would ask the central bank for a loan instead of issuing debt. Once the economy recovers, the government can increase fiscal pressures and repay the loan. By doing so, crashes are softened with a direct liquidity injection, while booms are tamed when liquidity is tightened.

This Friedman model seems a good starting point today, because we urgently must implement brave measures. Unfortunately, it’s unthinkable that the Bundesbank would even have a peek at it. Europe still is unaware of where it stands, and the dangers awaiting ahead.

Be the first to comment on "Even Milton Friedman would bless central banks cancelling debt"