Of all the arguments I have heard against monetary normalisation, I would definitely highlight the potential destablising effect which it could have on some financial markets. Especially the fixed income market. And I am not emphasising this in a positive way: I sincerely believe that delaying a decision which can help reduce uncertainty in the medium and long-term to avoid a negative impact (which I think will be limited) in the short-term is, without any doubt, questionable. Even more so when some of the adjustments pending in the medium and long-term, like a clear strategy on public debt adjustment, may be postponed indefinitely in an artificial context of excessively lax financial conditions. But it’s clear the central banks have to consider a whole range of factors when establishing a strategy for monetary normalisation. And they need to be clear and transparent when they explain this.

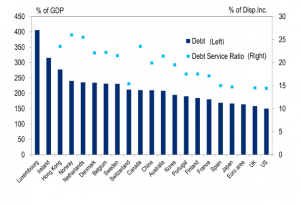

The management of debt, a large amount of debt, was one of the implicit reasons driving the ultra-expansionary monetary measures implemented by the main central banks. And in terms of private debt, there has been an important adjustment. In Spain for example, there has been a decline of more than 30% in the debt accumulated by companies and households since the start of the crisis. In my opinion, this adjustment may be coming to an end. In the case of public debt, the conclusions are not so obvious.

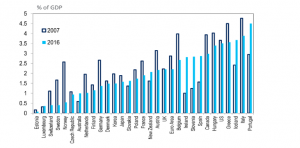

These two graphics are from Citi. The first one, the balance of private debt (% GDP) and its financial service (% available income)….And in the second graphic, we have public debt service (% GDP), its trend over these crisis years…

Without a doubt, the decline in interest rates combined with the central banks’ asset purchases have led to an improvement in financial conditions. And in many cases this has compensated the actual growth in the stock of public debt. In the end, the explicit objective of these measures was clear: facilitate the adjustments, both economic and financial, to enable strong economic growth and fight against the risk of deflation. That said, I don’t think it makes any sense to maintain financial conditions which are too lax to mitigate the cost of the imbalances like high debt at the cost of creating new uncertainties in the medium-term. The adjustments which still need to be made, economic, financial and even structural as in the case of the banks, should be carried out when conditions are favourable. Forcing these conditions when they are not necessary from a fundamental point of view doesn’t make sense.