Of course, this does not mean that euro area yields will remain at these levels in the near term, but it does lend some support to our year-end 10yr Bund yield forecast of 0.90%.

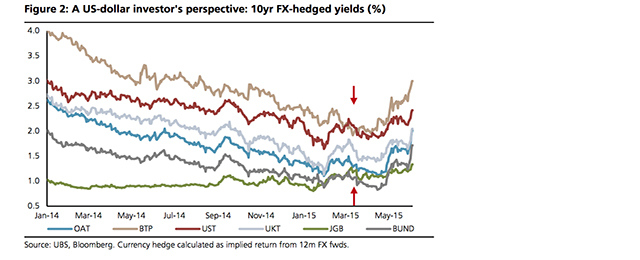

The table above outlines 10yr yields in a number of government bond markets, currency-hedged with 12m FX forwards for investors in various domiciles.

The hedged yield advantage of US Treasuries has fallen lately, but remains significant. French and UK bonds tied for second place, followed by Swiss and Dutch bonds. German Bunds still appear unattractive as an outright purchase. To be fair, Bunds do yield significantly more than Japanese and Australian bonds when FX-hedged.

Unlike a couple of months ago, euro area peripherals now offer substantially higher FX-hedged yields than all other markets in our sample.

Be the first to comment on "The cross-market context of bond sell-off"