Among the measures already implemented (TLTROs, covered bond and ABS purchase programmes), the TLTRO is expected to provide the most sizable contribution to the ECB balance sheet expansion. Therefore, the December TLTRO is an important test of the capacity of the current measures to get the intended €1trn balance sheet increase.

For the September and December TLTROs, banks’ borrowing capacity corresponds to 7% of TLTRO-eligible loans (ie, loans to firms and households, excluding loans for house purchases) as of the end of April 2014. For the four TLTROs in 2015 and the two in 2016, each bank’s borrowing allowance will depend on the evolution of its lending to the real economy.

We expect better results than in September, but still not a sizable balance sheet expansion

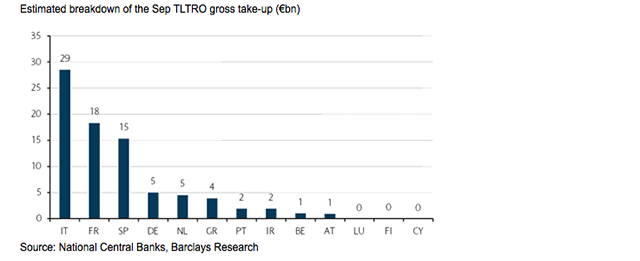

At the September operation, of a total borrowing allowance of about €200bn (calculated on loans data submitted at the end of August), banks borrowed €83bn, which, net of the 3y LTRO repayment and of the roll from the MRO, resulted in a net liquidity injection of €48bn.

For the December TLTRO, we expect better results, with a gross take-up likely to be around €180bn (consensus at about €150bn). However, we see the risks as significantly skewed to the downside. This is because the residual allowance from the September operation amounts to about €120bn, much lower than the €310bn estimated as potential – ie, the €400bn mentioned by ECB President Mario Draghi when he announced the operations, net of the September gross take-up (€83bn). Therefore, if no other banks decide to participate to the December TLTRO outside of those that borrowed at the September operation (deadline for the submission of the TLTRO eligible loans data was November 20) €120bn is the maximum amount that can be borrowed at this week’s operation.

Although some additional banks are likely to take part in the December operation, as the timing now is better than in September (the AQR results have now been published and banks have already completed their budget plans for next year, giving them a clear idea of the SMEs’ lending strategies and funding needs for next year), there is also a risk that banks could adopt a cautious approach. This is because of the uncertainties on the economic outlook, particularly the evolution of demand for loans, which could make it difficult for banks to meet the conditions in terms of the lending benchmark embedded in the TLTRO.

In terms of net liquidity injection, we maintain our expectation of around €100bn of net borrowing on the settlement day of the operation, but we recognise that our estimate has heavy downside risks attached. The creation of new liquidity (ie, balance sheet expansion) will crucially depend on the participation of banks in core countries, which currently have a low amount of ECB borrowing, and on big banks in the peripheral countries that have a large allowance and have already repaid a significant part or the entire amount of their initial 3y LTRO borrowing.

Importantly, even in case of gross take-up in line with our above-consensus view of €180bn, we believe that the December TLTRO, coupled with the other measures already announced by the ECB, will still not be enough to expand the balance sheet by the intended €1trn. Indeed, as we explain in the Money Market section of the 2015 Rates Outlook, with the current measures, we believe the ECB will be able to expand its balance sheet only by about €350bn by the end of 2015 (net of the securities maturing and of liquidity that will not be rolled).

Results similar to the September TLTRO would reinforce expectations of QE as early as the ECB’s January 2015 meeting

In terms of market reaction, a take-up in line with the consensus or even to our above-consensus view should not be enough to change the market stance that the ECB needs to embark on QE to boost its balance sheet by the intended €1trn. A result in line with the weak September TLTRO results would likely reinforce market expectations of an announcement of European government bond purchases (EGB-QE) at the ECB’s January 22 meeting. Under this scenario, we would expect a further inversion of the Eonia curve, with the very front end (up to three months) suffering from upward pressure due to the lack of a significant injection of liquidity in the near term, while the long part of the curve would likely benefit from the strengthening of expectations of a significant improvement in the liquidity conditions, especially in the second part of next year, when the surplus heading toward €300bn should create the conditions for the Eonia fix to stay at around -10bp.. Therefore, we stick with our trade ideas to go long the ECB October Eonia and 3m Euribor December 15 future.

Be the first to comment on "December TLTRO: A window on the ECB’s future actions"