The risk premium embedded in EM equities is now in line with DM equities having been well above the DM premium at the end of 2013, funds flow has returned to EM suggesting that previously depressed sentiment has lifted, while earnings estimates are still being cut, as Barclays analysts commented on Wednesday.

“Although the direction of US monetary policy has not been a dominant influence on EM equity performance in the past, the prospect of rising US bond yields ahead of Fed tightening in Q2 2015 could also provide a headwind for EM equities,” they pointed out.

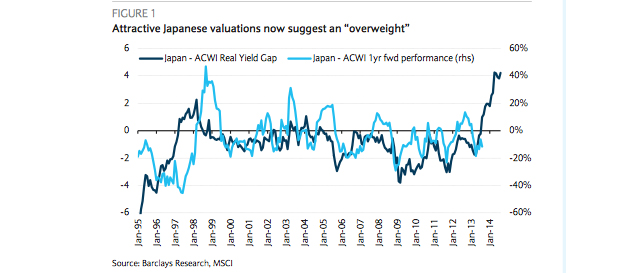

Also, they are upgrading their stance towards Japanese equities from neutral to overweight.

“Unlike prior attempts to rise above 1300, the Topix’s recent rise is not due to foreign buying, while corporate behaviour is changing with a resulting clear improvement in profit margins. Japanese valuations are very low compared to the rest of the world.”

The main impediment, in their view, remains the low payouts to shareholders

“However heightened government and shareholder focus on this issue may encourage companies to return more resources – they certainly have ample financial capacity to do this.

Be the first to comment on "Downgrading EM, upgrading Japan"