First, the take-up of December TLTRO should bring more clarity on whether the ECB can reach the targeted expansion of its balance sheet by about EUR 1trn with its existing programmes, which we doubt will be possible. Second, on 14 January, the Advocate General of the European court of Justice is going to give his opinion on the ECB OMT case, which could reveal the court’s view on many aspects related to ECB government bond purchases. Finally, inflation appears set to decline further in December and may fall to 0.0%, as close to negative territory as it gets. This should add pressure on all ECB Governing Council members to agree to further substantial policy easing, which, at this stage, can come only through government bond purchases.

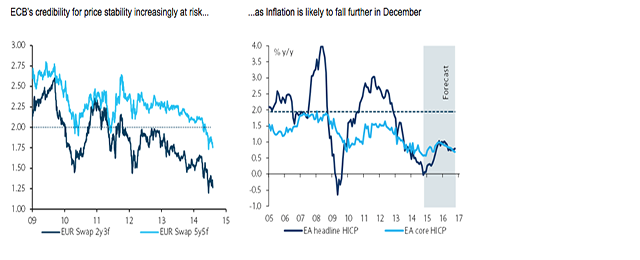

Market-based measures of inflation expectations increasingly indicate that the ECB is at risk of losing its credibility to return inflation back to the close-but-below 2% target even over the medium term (Figure 1, left). President Draghi made clear in a recent, candid speech in Germany that he deems inflation expectations at shorter horizons excessively low while highlighting the low reading of core inflation. Although he maintained that longer-term indicators on the whole remain within a range that the ECB considers consistent with price stability, his language increasingly reflects the growing concern that they could soon fall below this range. After the latest rout in oil prices, the 5y5y forward market-based measure of inflation expectations (not adjusted for an inflation risk premium) has again resumed its downward trend and fallen below 1.8%.

Headline inflation likely to remain below 1.0% through the forecast horizon

We expect euro area headline HICP inflation to average 0.4% in 2014, 0.5% in 2015 and 0.9% in 2016. Compared with our previously published profile, we lowered our forecast by 0.1pp each year of the forecast horizon. After having declined to 0.7% recently, we expect core inflation to hover around 0.8% next year before inching up to 09.% in 2016 (Figure 2, above right). Along with the positive effect of a modest projected pickup in economic activity, we expect a lagged pass-through effect stemming from a weaker euro to support non-energy industrial goods prices from Q1 onwards. However, any upside pressure will likely be offset by a continuation of the current secular trend in core services prices, as we expect supply- and demand-side shocks to keep non-tradable services prices on a declining trend, albeit at a more moderate pace than before. Moreover, we expect protracted weakness in oil prices to filter through consumer prices more broadly, adding further downward pressures to headline inflation. For this reason, we continue to think that risks attached to our revised projected profile remain skewed to the downside. In the short term, we tentatively expect inflation to decline to 0.0% in December from 0.3% in November and to improve gradually thereafter.

Finally, we expect the ECB to revise lower its inflation projection. In September, the ECB expected euro area HICP inflation to average 0.6% in 2014, 1.1% in 2015 and 1.4% in 2016. Taking into account the sharp drop in oil prices and other developments over the past quarter, we think that the projected profile is likely to be revised down 0.1pp this year and 0.2pp in 2015 and 2016 (with downside risks). Altogether, we think that the latest inflation readings and expectation developments should soon be qualified as another marked deterioration in the inflation outlook by the ECB, especially if inflation and inflation expectations fall further over the next few weeks. This was mentioned as one of the contingencies by ECB President Draghi for further substantial policy easing.

ECB balance sheet expansion modest so far

Although the new asset purchase programmes have started just recently, we believe the latest developments confirm our view (see, Euro Themes: Stuck in low-flation, 18 November) that they, together with the TLTRO liquidity operations, will prove insufficient to expand the ECB’s balance sheet by the EUR 1trn it aims to achieve. The September TLTRO and the latest covered bonds purchase programme (CBP3) have failed to provide a meaningful (net) liquidity injection taking into account the ongoing 3y LTRO repayments and have so far added only modestly to the ECB’s balance sheet (total ECB assets amounted to EUR 2,054bn on 28 November, compared with 2,039bn at the end of August). ABS purchases started last week, with EUR 0.4bn bought adding to the EUR 17bn bought so far under the CBP3 programme. The volume of ABS purchases may pick up somewhat, while we expect a slower pace of covered bond purchases. In any case, both are unlikely to add more than EUR 300bn (in gross terms) at best over a two-year horizon, in our view.

Much hope rests therefore on the TLTROs, although the ECB revised down its initial expectations of how much liquidity they may add when they were announced. For the December TLRO (allotment on 11 December), we expect a gross take-up of EUR 180bn at best, which would correspond to borrowing of about EUR100bn – net of the liquidity reversal from 3y LTROs or from other operations into the TLTRO. However, even if the December TLTRO meets our expectations, we believe that the ECB may already announce at its 22 January Governing Council meeting that the pace of balance sheet expansion is slower than expected (the second contingency for more ECB policy easing) and that it could be difficult to expand the ECB balance sheet as targeted (+ EUR 1trn) unless government bonds and potentially other assets such as corporate bonds are included in the purchase programme.

Legal issues

To be most effective, at least in theory, an ECB government bond purchase programme should be very large and private creditors should not be subordinated to ECB claims on member state debt. Whether this is legally feasible under the current EU treaties is currently under review by the European Court of Justice (ECJ) – see The ECB’s OMT under legal review, 17 October 2014. There is a risk, in our view, that the EU court may agree with Germany’s constitutional court that the ECB cannot promise pari passu treatment with other creditors in the case of nominal losses (haircuts) on its public bond holdings but must insist on full repayment. This could eventually limit the effectiveness of ECB government bond purchases. On 14 January, the EU court’s Advocate General will issue his opinion, and the court often follows the views of the Advocate General. A final ruling, however, may take a few more months. In principle, the EU judges may flatly reject the views of the German court, but the latter left open, at least theoretically, the possibility that it will not consider itself bound by an ECJ ruling if it considers it a modification or violation (by the ECB, in this case, acting ultra vires in legal speech) of the EU Treaties that could be grave enough to impinge on Germany’s basic law (the German court voted 6:2 that the latter could be the case). However, it is unlikely that the two courts will not find some compromise and head into a constitutional crisis over these issues, and legal experts mostly see this as an opportunity to establish a more balanced relationship between the ECJ and EU member states’ highest courts.

Be the first to comment on "ECB preview: Not yet"