Although Mario Draghi stirred many critics for not being more specific about the size of the ABS and covered bond purchases by the ECB, some analysts gave him credit.

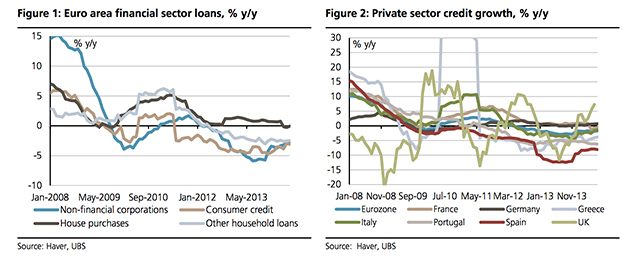

“The ultimate goal is credit growth, not balance sheet growth. Put differently, we feared that Mr Draghi and the ECB had painted themselves into a corner by stressing specific balance sheet targets that they might struggle to attain,” UBS analysts stressed.

Once again, Mr Draghi said they didn’t rule out sovereign QE, but given the recent monetary easing moves it may not take place in the first quarters of 2015.

“Even beyond this period, full-scale QE is not our base case scenario, given our projection that HICP inflation has now bottomed and should start to creep up again as of October, to 0.7% by end-2014 and 1.3% by end-2015,” UBS team commented.

Be the first to comment on "ECB: More questions than answers"