The ECB will insist that it intends to implement QE in full – ie at least until September 2016.

Our base case scenario is that the ECB’s QE will run until September 2016, but we still see lots of uncertainty around this call (not least related to difficulties in forecasting the output gap). Also, we do not take it for granted that the ECB will reduce its monthly asset purchases from €60bn to zero in one fell swoop.

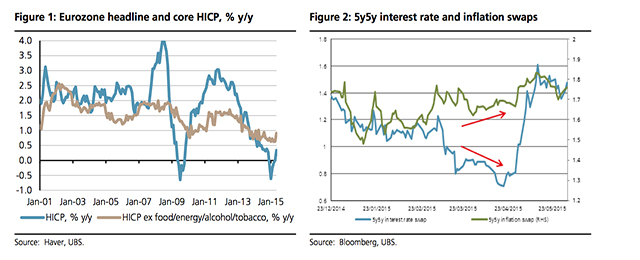

This positive inflation surprise follows a streak of broadly better-than-expected data releases for the Eurozone. We continue to think that as Eurozone data recovers, bunds will continue to sell off at the back end, helping the EUR to stabilize within a broad range. The underlying recovery in earnings (and the market expectation thereof) will underpin ongoing strength in European equities despite higher rates.

Be the first to comment on "ECB unlikely to change the message that it intends to implement QE “in full”"