European equities first quarter results so far beat analysts expectations for revenues, showing that a recovery in demand is driving sales. In fact, analysts at Carax-Alphavalue show themselves “struck” by the Q1 releases with frequent mentions of better top lines due to emerging market demand, for which read China. They explain:

While we wonder how much of this surprise pull can extend into H2-2017, it is worth taking another look at the 2017 earnings outlook and the stream of upgrades

Experts start with 2016. Eps growth is stabilising at +8% which is 2% above last March’s expectations. “This is an important starting point”, they point.

2017 eps growth is now running at +18% which is about 160bp above last March’s expectations. This is good as the previous year’s base itself has strengthened.

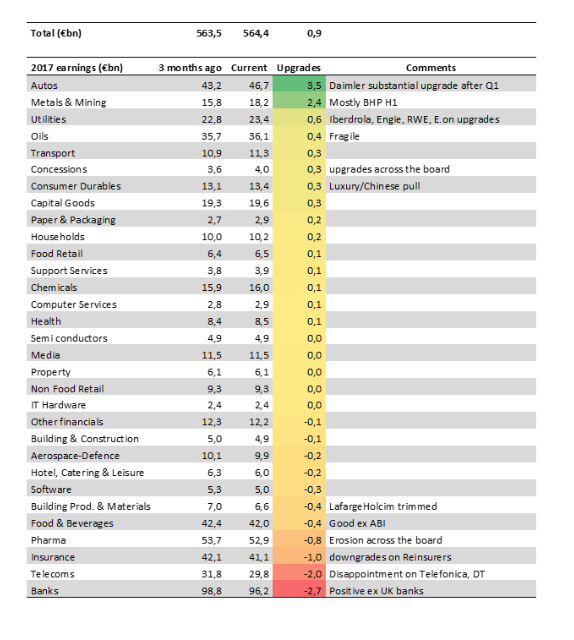

Here is the current situation on an average and median basis.

The earnings revisions are worth commenting on a sector by sector basis. Therefore, they note that this will embark currency effects as all data is compiled in

Euros. In addition, the aggregate sector data does not reflect changes in the number of shares so that figures below in €bn will differ from the

eps revision view. What matters is the direction of travel.

In addition to comments per sector in the table, it is worth mentioning that Telcos are not up to earlier hopes such that sentiment on the sector

may remain unconvinced beyond the fact that the sector is a laggard. Continental Banks are experiencing general upgrades which are sadly

being absorbed by the British downgrades. Finally Daimler’s Q1 was a firework after which upgrades to 2017 earnings pulled up the whole sector.

All in all, it is a solid base for the European bulls.