The bad price index data led European stock exchanges towards red, restraining last days increases. This reaction suggests that investors are expectant and waiting for next Thursday to take positions.

Markets consider the ECB is to cut interest rates, remain a negative deposit rate and announce measures for the credit to reach peripheral small and medium companies. The central bank may even open the door to an eventual quantitative easing in next months, more focused on private debt purchases.

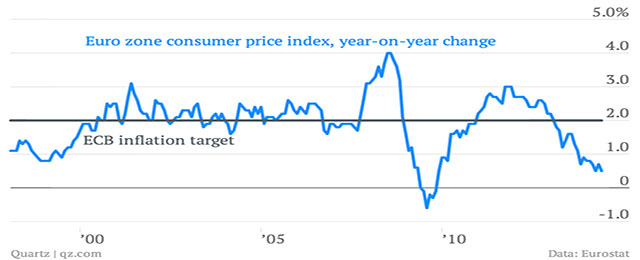

The euro zone inflation in now at 0.5% as a consequence of prices falling in Spain and Italy. The price index records higher in the so-called core countries, although their shopping baskets, for instance Germany’s, have strongly declined due to cold winter temperatures.

The truth is that the ECB’s inflation goal at 2% increasingly moves away, although the institution always reminds it acts according to inflation expectations, not last month figures.

The ECB will publish an update of its economic forecasts on Thursday, but May’s numbers point that inflation estimates could be revised downwards, around 0.3% by 2014. Worries about prices drops currently grows. Last week Mr Draghi warned again over the dangerous effects of a low inflation and credit contraction spiral on the euro zone economies. Time to act.

Be the first to comment on "Falling EZ inflation makes it tricky for Draghi"