While most of the attention circles around the Spanish Treasury’s upcoming sale of €4.5 billion in 3, 5 and 13-year bonds, Afi analysts on Thursday said it is worth having a look at the non-government debt sector. Foreign investor appetite seems to be growing, and fears are on the receding trend.

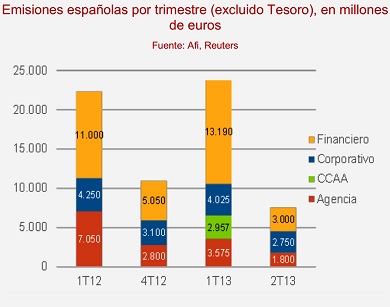

Spanish financial entities and corporations have seen their market access improve, costs fall and maturities extended. In fact, up to 80 percent of issuances–some €30 billion so far this year–were bought by non-resident investors. Proof that confidence is on its way of being restored over non-Treasury Spanish debt, too, shows in the use of different currencies and hybrid products: Telefonica sold $2 billion in bonds and BBVA has placed €1.5 billion in convertible subordinated debt.

Broker Bankinter said it expects the cost of 10-year credit for the Spanish government to reach levels below the 4 percent mark during the next auctions.

In Madrid, news about Joerg Asmussen–the German representative at the European Central Bank–asking for a speedy Banking Union was also welcomed. Asmussen mentioned the difficulties of the Cyprus rescue as a “reminder” that the “negative interaction” between banks and sovereign debt must be cut, and the ECB should begin its task as eurozone banks’ supervisor as soon as possible.

Be the first to comment on "Foreign investors return to non-Treasury Spanish debt"