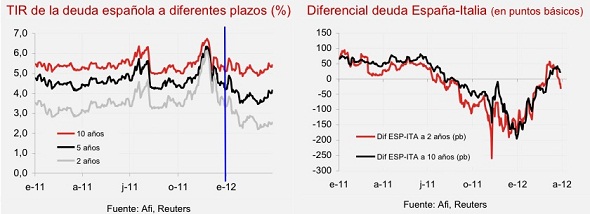

AFI analysts duly noted on Friday that markets have again focused their irritation on Italy and Spain. Corrections have shown a measure of the punishment investors are willing to inflict on those euro zone member countries seen as the weakest link unless Brussels gets its act together, since domestic solutions will necessarily be patchy.

“Spanish and Italian sovereign debts have this week become protagonists, particularly over the short section of the curve, with a spike of yields. Italy’s 2-year bond yield has increased by 30 basic points or 2.9pc, surpassing the mark of the Spanish reference.”

Be the first to comment on "Friday’s graph: 2-year Italian bond yields"