After New Democracy's win in the recent general elections in Greece with 29.8 percent of voting support, a coalition with Pasok seems the most reliable option. Together, both parties would gather 162 parliament seats and a sufficient majority (overall majority is obtained with 151 seats) to raise a stable government favourable to accept further austerity measures from the European Commission. But accords have not yet been signed, and negotiations with the commission, the European Central Bank and the International Monetary Fund are still pending.

The total capital aid package has now reached €172.6 billion. Already in July 2011, the second bailout had better conditions. The new debt had

a 15-year maturity deadline instead of seven, and it could be extended to 30 years, while the interest rate was cut from 4.2 percent to 3.5 percent. As the interest rate cannot be set lower than that of the European Financial Stability Fund issues, which is an average 0.18 percent, there sure is room for discussions in Athens.

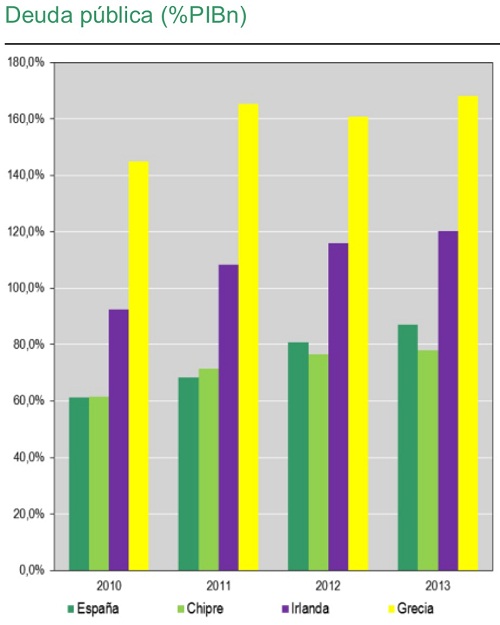

Room for maneuver is not the same as time, though. This chart from BNP Paribas says why, comparing public debt per GDP levels in Spain, Cyprus, Ireland and Greece from 2010 to next year.