“We believe the actions of the authorities in Europe represent a step change,” Invesco Perpetual said Wednesday in a Global Financial note. “[They have] shifted investors’ perceptions of the eurozone’s debt markets and the European banking system,” the report added. But analysts at Invesco’s Fixed Interest department, which published the study, believe something else: that British banks have benefited from the European Central Bank (ECB) interventions as much as those in the euro area.

The Frankfurt-based central bank has not been alone in its efforts to drive down risk premiums and calm markets so credit was more affordable. Sentiment on the financial sector, in fact, has improved everywhere in spite of an abundance of negative news. The critical state of eurozone economies, though, was the key that stretched the ECB’s previously firm stand against giving monetary support. And this made the difference.

From a low of just over 6 percent in 2007, the banking industry of the whole European Union–including sectors out of the common currency zone–has now increased its core capital to over 11 percent. This is a significantly larger cushion to absorb losses.

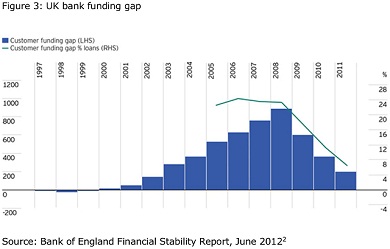

The refinancing transactions with the ECB have helped banks to raise deposits and reduce their dependence on wholesale market funding. “Data show just how much progress has been made by UK banks in closing the funding gap (the difference between customer lending and customer borrowing) which emerged in the run-up to the financial crash as they sought to accelerate the growth of their businesses through borrowing on the wholesale market,” as Invesco put it in its paper.

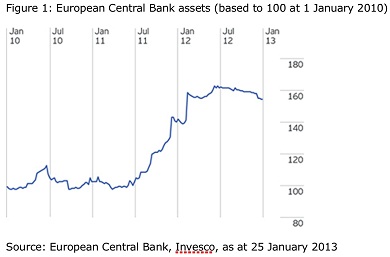

Indeed, concerns over funding in the European banking system were effectively dealt with by the ECB’s Long Term Refinancing Operations. In two exercises, in December 2011 and February 2012, over 800 banks took a total of €1,090 billion in loans at three years.

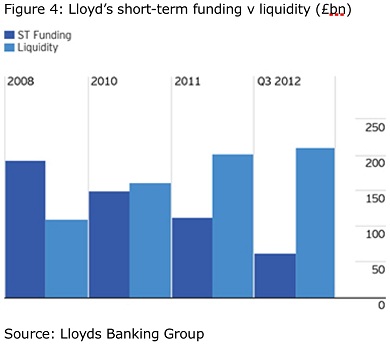

“The improved liquidity on Lloyds’ balance sheet exemplifies the work that has been done. From a position in 2008 where short-term funding was nearly double the level of liquidity, in the third quarter of 2012 it had fallen to just over one quarter,” Invesco experts explained, “[and] a considerable part of this improvement has occurred in the last year.”

No wonder the British government feels confident enough to float the idea of selling its 40 percent stake in Lloyds. Chancellor George Orbone may even take some extra money home from the initial £20 billion investment of public funds. Unfortunately, it seems unlikely that he or prime minister David Cameron ever thanks its neighbours in the continent for the nice outcome.

Be the first to comment on "How eurozone’s central bank saved Lloyds"