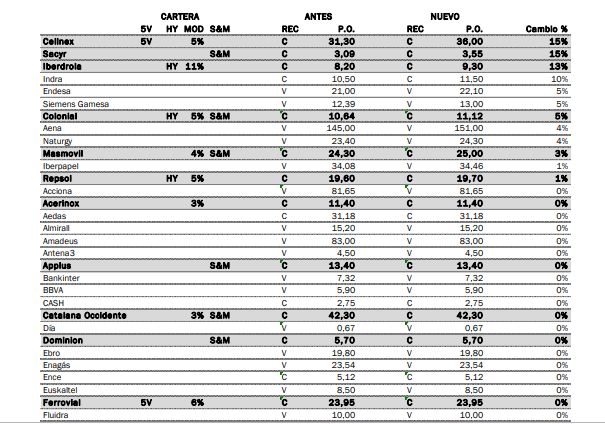

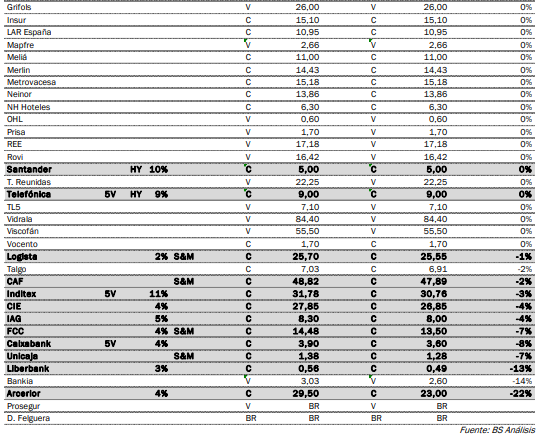

Sabadell released its market report where its analysts revise all the forecasts and objective prices for the companies they cover and highlight their favourite shares in their portfolios (model, 5 value portfolio, high yield and SME portfolio).

“We do not change our recommendation but significantly revise the valuation of Cellnex (+15%), Sacyr (+15%), Iberdrola (+13%), FCC (-7%), Unicaja (-7%), Caixabank (-8%), Liberbank (-13%), Bankia (-14%) and Arcelor (-22%). Of all the shares covered (65 vs 67 in the last edition of this report), there are 55% in BUY (vs 53% in the last edition) and 45% in SELL (vs 47%). At a top down level we value the IBEX December 2019 at 9,030 points (vs 10,660 in the previous edition), with an implicit PER December 2019 of 11.7X vs the 12.0X currently trading forward 12 months and of 11.2X average forecast for 2010-2020. At a bottom up level, and assuming the latest changes of composition already announced (in effect 24 June 2019), we value the IBEX at 10,782 points, which leaves a potential of +18%, with the greatest margin in banks and cyclical shares. In the following table we show a summary of objective process with changes and recommendations.”